Diesel and petrol power continue to crash in most categories as electric and hybrid vehicles find growing favour at the expense of internal combustion engine (ICE) equivalents.

Diesel and petrol power continue to crash in most categories as electric and hybrid vehicles find growing favour at the expense of internal combustion engine (ICE) equivalents.

The continuing trend is confirmed by the latest VFACTs figures from the Federal Chamber of Automotive Industries (FCAI).

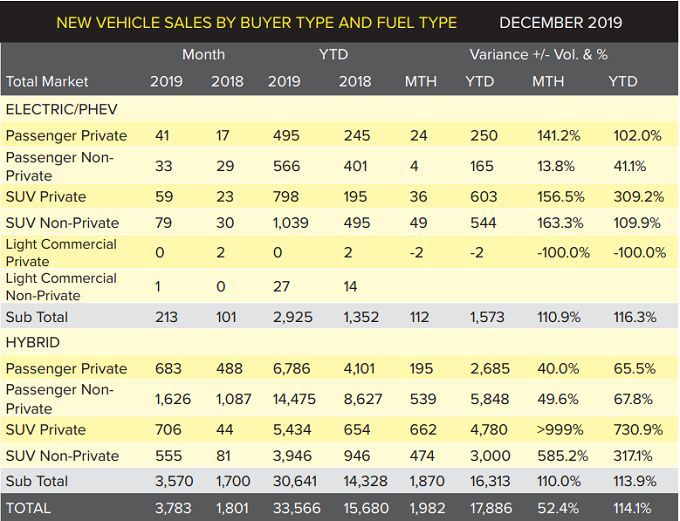

New vehicle sales by buyer and fuel type show massive rises in interest for December 2019 and year-to-date (YTD) totals in the electric/plug-in hybrid (PHEV) and hybrid categories.

Electric/PHEV sales in the private passenger sector, for instance, soared 141.2% in December 2018 to December 2019 comparisons (17 to 41) and 102% YTD (245 in 2018 to 495 in 2019).

The jump is also marked in the SUV category, with private SUV sales rocketing 156.5% (23 to 59 in December EV/PHEV comparisons) and 309.2% YTD (195 in 2018 to 798 for 2019).

Non-private SUV sales of electrics and PHEVs also went up 163.3% (30 to 79) in the monthly comparison and 109.9% YTD (495 to 1039).

A more modest rise shows in the non-private passenger EV/PHEV category, going up 13.8% in December comparisons (29 to 33) and 41.1% YTD (401 to 566).

Hybrids continue to rocket ahead in all the categories in which they feature.

Private passenger hybrid sales go from 488 in December 2018 to 683 in December just gone (up 40%) and from 4101 in 2018 to 6786 in 2019 (65.5%).

It’s a similar story in the hybrid non-private passenger sector.

Here hybrids climb 49.6% in December comparisons (1087 to 1626) and 67.8% YTD (8627 in 2018 to 14,475 in 2019).

Hybrids record even bigger jumps in the SUV categories.

In the private SUV market they go up more than 999% in December comparisons (44 in 2018 to 706 in 2019) and 730.9% YTD (654 in 2018 and 5434 in 2019).

The non-private SUV segment sees hybrids go from 81 in December 2018 to 555 in December 2019 – up 585.2%, and from 946 YTD in 2018 to 3946 (up 317.1%).

Electric/PHEVs show little change in the light commercial categories – none recorded in the private sector during December 2019 as against just two in December 2018 and the same result applying in annual comparisons.

In the non-private sector that went from zero in December 2018 to just one in December 2019 – YTD totals showing a lift from 14 in 2018 to 27 in 2019 (up 92.9%).

Interestingly, hybrids are outgunning diesel in the passenger market, the latter recording 177 December 2019 sales (against 683 for hybrids) in the private area and 387 diesel sales in the non-private category (1626 hybrids).

But the reverse is true in the SUV market, with petrol still the preferred fuel there and diesel next.

Diesel is the fuel of favour in the light commercial market with electric and hybrid equivalents yet to come out or take hold.

Another market where few fuel alternatives are available is the heavy commercial sector, sales dropping slightly there.